reit dividend tax malaysia

Areca Capital is committed towards safeguarding the interests of our investors. There is a limit to the amount of foreign tax credit received.

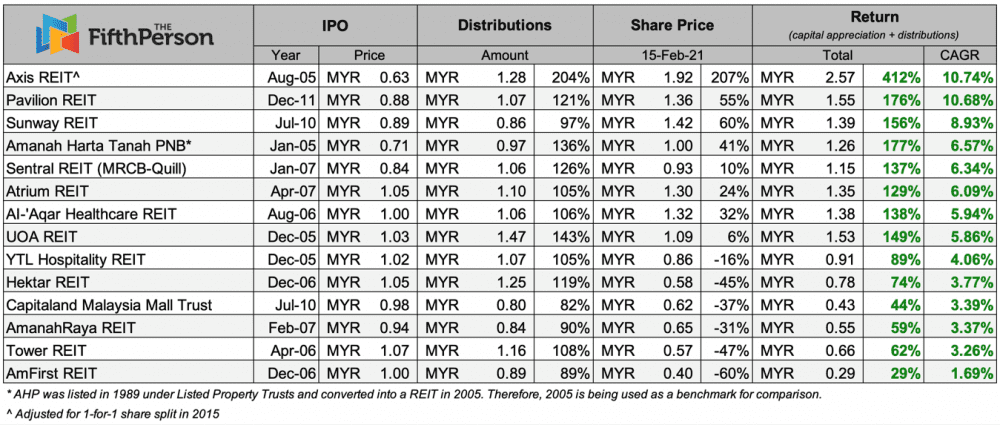

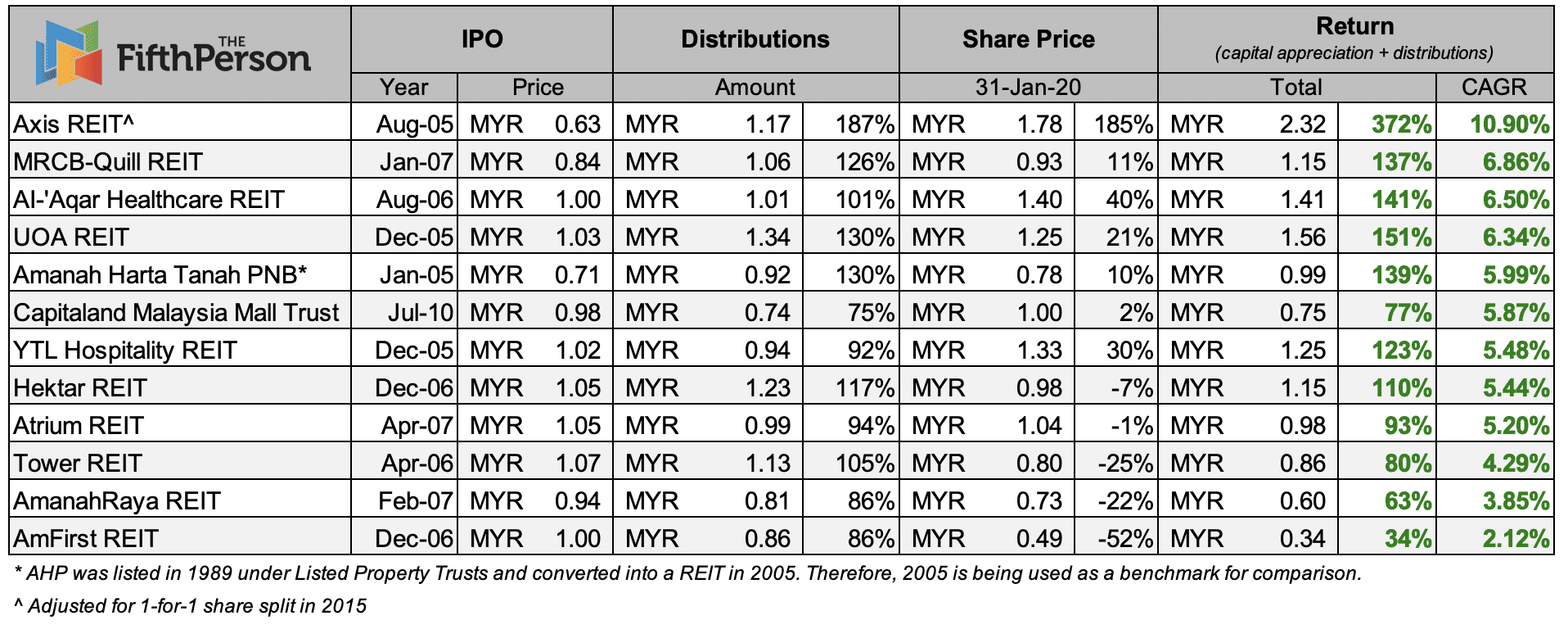

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

This required Microsoft to incur a one-time net charge of 137 billion on the repatriation of deferred foreign income not previously subject to US.

. With this tax system most Malaysian REITs if not. The higher distributable income was partly funded from the issue of 100 million of perpetual securities in the 4QFY2021 to finance the new acquisitions. DollarDEX Investments is an online wealth management platform designed for everyone to invest.

Malaysia business and financial market news. It will mostly be hit by the one-off 33 prosperity tax that will be imposed on taxable income above the. Microsofts net income fell in FY2018 due to the Tax Cuts and Jobs Act which was enacted in December 2017.

Worldwide Real Estate Investment Trust REIT Regimes Compare and contrast 2 Introduction 3 Australia 4 Belgium 6 Brazil 11 Bulgaria 14 Canada 17 Finland 20 France 23 Germany 27 Greece 30 Hong Kong 34 Hungary 37 India 41 Ireland 46 Italy 49 Japan 53 Luxembourg 56 Malaysia 60 Mexico 64 New Zealand 68 Singapore 70 South Africa 75 South Korea 80 Spain 83 Taiwan 86. REITTrust and Closed Ended Fund. BURSA MALAYSIA Registration No.

The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax. 7 on each item.

For ETFs trades stamp duty will be waived from Bursa Malaysia until 31 December 2025. Goods and Services Tax GST. Dividend per share improved 400 year-on-year to 56 sen in 2021 but was still 44 lower than the pre-pandemic level.

This allows the REIT to distribute its income on a gross basis. The dividend paid to shareholders can make tangible the wealth generated by the company. As Malaysia and Singapore reopened their borders Carlsberg Malaysias road to recovery is bumpy but on track.

Malaysia Smelting Corp the worlds second-biggest tin producer tumbled to a two-year low in Kuala Lumpur trading after reporting a second-quarter loss because of a slump in the price of the metal. Of being above 10. Malaysia Revenue Stamp Duty.

Keppel DC REIT is the first pure-play data centre REIT listed in Asia on the Singapore Exchange. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate. The rate in column 2 applies to dividends paid by a RIC or a real estate investment trust REIT.

Losses before tax for trucking services meanwhile narrowed down by -567yoy due to continuous cost-saving. 97601004668 30632-P Contact Us Personal Data Notice Terms Conditions Help We use cookies to give you the best experience on our Website. Thus 10000 of the distribution is treated as a dividend pursuant to Section 316 while the remaining 2000 is either a tax-free return.

According to tax law. Manhattan Bridge Capital LOAN Declares 0125 Quarterly Dividend. YTL Corp Bhd reported a net profit of RM41461 million for its third quarter ended March 31 2022 3QFY22 over 18 times the RM2243 million it posted in the same quarter a year ago mainly due to a one-off gain from the disposal of its investment in ElectraNet PtyThe groups revenue jumped to RM617 billion from RM422 billion its bourse.

One huge tax benefit of a REIT is that most income earned by it is exempted from income tax. Cromwell European REIT CEREIT has reported distributable income of 233 million 341 million for the 1QFY2022 ended March 71 higher y-o-y. The REITs investment strategy is to principally invest directly or indirectly in a diversified portfolio of income-producing real estate assets which are used primarily for data centre purposes as well as real estate-related assets.

KUALA LUMPUR May 26. 18 Yield Get RSS Feed More News. REIT MLP BDC Clean energy Uranium Lithium Precious metals Water.

Handling charges charged by RegistrarIssuer subject to issuerregistrar ranging from RM0 - RM10. News explorer - Read todays most read article on London Stock Exchange and browse the most popular articles to stay informed on all the top news of today. Is a clear indication and easy to obtain.

Zacks free daily newsletter Profit from the Pros provides 1 Rank Strong Buy stocks etfs and more to research for your financial portfolio. Prevention of any incidence of cash mishandling or mismanagement while heeding Bank Negara Malaysias desire for electronic payment methods for greater efficiency transparency and accountability. This is conditional upon the REIT ETF distributing all the distributions it receives from the underlying S-REITs and that these distributions are made during the period from 1st July 2018 to 31st March 2025.

Most countries laws on REITs entitle a. As a subsidiary of Singapore Life Ltd we provide financial advisory licenced by MAS. Malaysia - 25 Malta - 35 Mexico - 10 Moroccco - 10 The Netherlands - 15 New Zealand - 30.

The stock sank 69 per cent to RM350 as of 1230 pm. Speaking of dividend rehabilitation Whitestone REIT WSR is on its own comeback path slowly trying to repair its payout following a deep 63 cut announced a few months into the COVID pandemic. TASCO share price TASCO quarter report TASCO financial report TASCO dividend TASCO dividend history.

The tax transparency treatment states that certain S-REIT distributions will not be taxed in the hands of the trustee of REIT ETF. However that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is an individual holding less than a 10 interest 25 in. Source-country tax on dividends will be generally limited to 15 subject to an exemption for dividends paid to certain pension funds or government investment funds beneficially holding less than 10 of the voting power in the company paying the dividend and a 5 limit that will apply to dividends paid to companies with voting power of 10 or.

To recall the CSC business handles approximately 80 of all the domestic ice cream market in Malaysia. Local time poised for its lowest close since July 7 2010. 86 Yield Targa Resources TRGP Declares 035 Quarterly Dividend.

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

5 Reasons Why You Should Invest In Reits Now By Jason How Zhi Yeong Smart Investor Medium

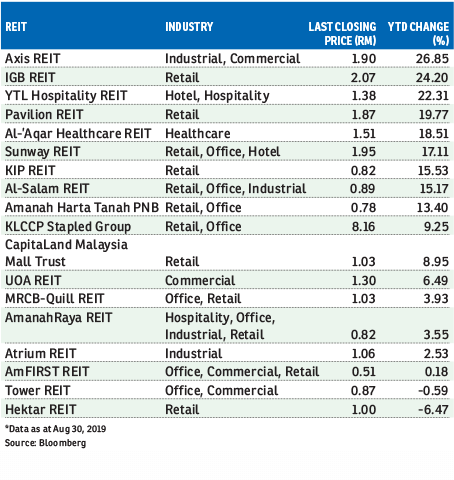

Reits Listed On Bursa Malaysia As At March 2016 Download Scientific Diagram

Real Estate Or Reits Which Is More Beneficial For Investment Purposes

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

The Ultimate Guide To Investing In Reits In Malaysia The World Bizweek

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Top 10 M Reits By Market Cap Rm B Source Midf 2016 Download Scientific Diagram

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

The Complete Guide To Reits In Malaysia Your Real Estate Partner

A Complete Guide To Reits Malaysia Real Estate Investment Trusts Youtube

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram

How Are Individual Reit Holders Taxed Thannees Articles

How Reit Regimes Are Doing In 2018 Ey Slovakia

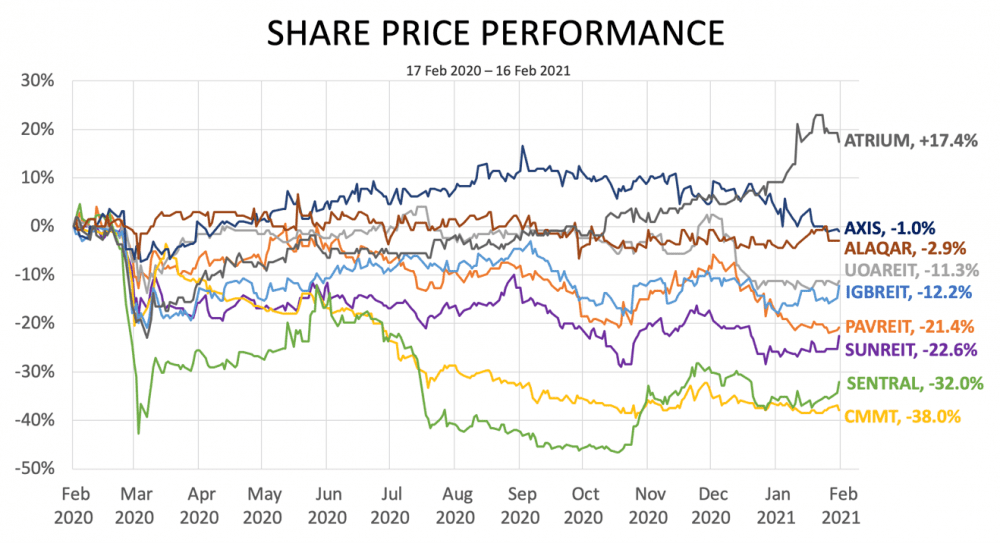

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How Are Individual Reit Holders Taxed

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider